How to Prevent Customer Churn: Cut Losses by 30% with Predictive Analytics

Customer churn costs businesses a staggering $1.6 trillion globally each year. Your priority list should have preventing customer churn right at the top.

The numbers tell a compelling story. Businesses spend five times more to acquire a new customer compared to keeping an existing one. Your bottom line has some good news though. A small 5% boost in customer retention can boost profits anywhere from 25% to 95%. Companies that exploit predictive analytics customer churn tools have seen their churn rates drop by up to 15%.

Let’s look at a real success story. Hydrant’s implementation of predictive AI for churn prediction and prevention led to remarkable results – a 260% higher conversion rate and a 310% jump in revenue per customer. McKinsey’s research shows that losing just one customer means having to acquire three new ones to break even.

These statistics paint a clear picture, yet many companies overlook crucial metrics. A surprising 24% of businesses don’t even track first call resolution rates, which plays a vital role in reducing customer churn. This oversight can get pricey, especially since executive teams using customer data analytics achieve 126% better profits than those who don’t.

In this piece, we’ll walk you through proven predictive modeling techniques to prevent customer churn. You’ll discover practical steps to spot early warning signs and implement targeted retention strategies that reduce churn and maximize customer lifetime value.

Understand Customer Churn and Its Business Impact

Customer churn poses one of the biggest threats to business growth and profitability. A solid grasp of this concept helps develop working strategies to keep your customer base and maximize revenue potential.

What is customer churn?

Customer churn, also called customer attrition, happens when someone stops using your products or services. Simply put, it means a customer no longer remains your customer. Companies track this through customer churn rate, the percentage of customers who ended their relationship during a specific timeframe (monthly, quarterly, or annually).

Every business loses some customers naturally, but high or rising churn rates need immediate action. Too much churn creates several problems: competitors can grab your market share, unhappy ex-customers might spread negative reviews, and your brand value takes a hit.

Different business models see varying effects from churn. B2C businesses usually have higher churn rates because consumers make quick decisions without approval processes. B2B companies feel the loss more deeply since they serve fewer customers with higher-value relationships. SaaS businesses that rely on monthly recurring revenue see churn directly affect their financial health.

Why reducing churn is more profitable than acquiring new customers

The numbers make a strong case to focus on reducing churn. Getting a new customer costs five to twenty-five times more than keeping an existing one. This cost gap grows even larger in some industries, insurance companies spend seven to nine times more to acquire versus retain customers.

A 5% increase in customer retention rates can boost profits by 25% to 95%. Returning customers spend 67% more on your company’s products and services.

Retention efforts give better returns than acquisition campaigns. Customer loyalty programs, customized communication, and proactive customer service cost less yet produce better results. Acquisition requires expensive marketing campaigns, sales commissions, and special offers for new customers.

The math becomes clearer when looking at customer lifetime value (CLV). High churn directly reduces CLV, calculated as “(ARPA × Gross Margin) ÷ Churn Rate”. A small increase in churn can reduce each customer’s lifetime value by a lot, which weakens the important LTV/CAC ratio that investors examine.

Types of churn: voluntary vs. involuntary

Different reasons cause churn, so understanding these types helps prevent it effectively:

Voluntary churn happens when customers decide to end their relationship with your business. This usually shows dissatisfaction or lack of value. Common causes include:

- Unmet expectations or goals

- Poor customer experience

- Unfriendly user interface

- Inadequate support

- Switching to competitors

Involuntary churn occurs when customers leave for reasons they can’t control. These customers wanted to stay but couldn’t because of:

- Payment failures (expired credit cards, incorrect billing information)

- Business closures

- Company acquisitions forcing adoption of different solutions

- Leadership or strategy changes

Involuntary churn makes up 20-40% of overall churn. While voluntary churn points to product or service issues, involuntary churn often shows process problems that you can fix with proper systems.

These differences help create targeted prevention strategies, using live analytics to spot at-risk customers and taking action before they leave.

Use Predictive Analytics to Spot Churn Early

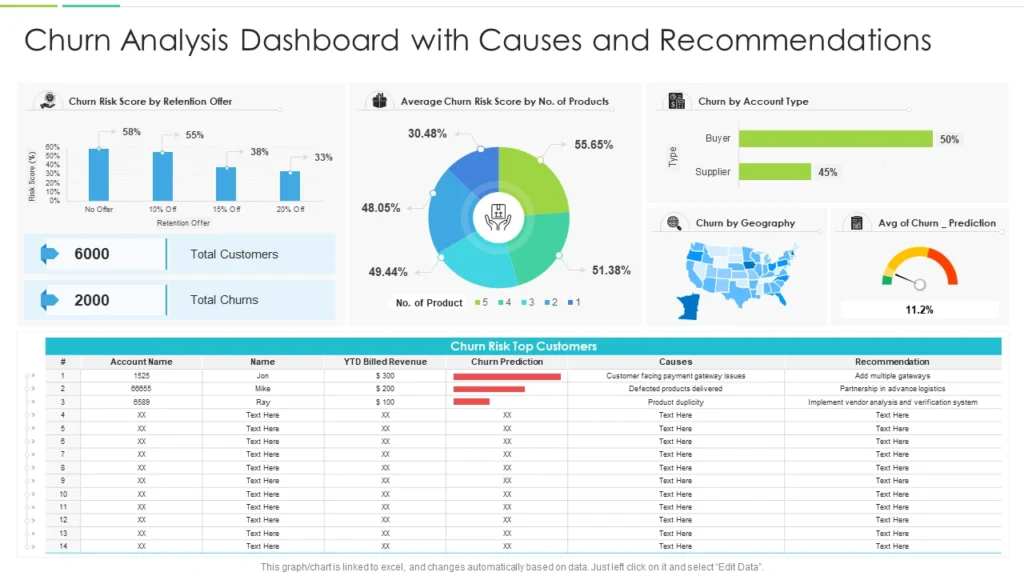

Image Source: SlideTeam

Predictive analytics has changed how businesses deal with churn prevention. Companies now move from reactive to proactive strategies. Instead of waiting for customers to leave, they can spot at-risk accounts weeks or months ahead and turn potential losses into retention opportunities.

What is predictive churn modeling?

Predictive churn modeling uses historical data analysis and machine learning algorithms to forecast which customers might stop doing business with you. Traditional methods depend on past trends and obvious warning signs. This new approach spots subtle patterns in customer behavior before clear warning signs show up.

Raw customer data becomes useful insights through smart algorithms that calculate churn risk scores for each customer. The goal is straightforward: to find which customers might leave while there’s still time to help them stay.

Gartner reports that companies using predictive analytics for customer retention see 15-25% fewer customers leaving. These businesses can respond up to 80% faster to at-risk accounts, which gives them a unique advantage over competitors.

Key churn indicators to track

The quickest way to predict churn needs tracking several data points that show customer unhappiness or lack of interest:

- Behavioral signals – Less product usage, fewer responses to emails or promotions, and different buying patterns

- Sentiment indicators – Customer feedback, support tickets, social media comments, and survey responses

- Activity patterns – How often they log in, which features they use, and time spent with your product

- Customer trip friction – Where users stop in your experience flow

- Support interactions – More support tickets or bad service experiences

To name just one example, see a customer who usually files one support ticket every three months suddenly files five in a month. Predictive models can tell if this pattern associates with past cases where customers left.

How predictive analytics customer churn tools work

Today’s churn prediction tools mix several analytical techniques to get better results. They follow a clear process:

The tools gather detailed customer data from CRM systems, product usage logs, support tickets, and financial transactions. After organizing this data, machine learning algorithms find patterns that associate with future customer departures.

These systems use various modeling techniques, including logistic regression, decision trees, neural networks, and ensemble methods. Each method works best in specific business situations and with different types of data.

Neural networks can spot complex relationships in customer data. Decision trees excel at showing clear paths of binary choices that lead to customers leaving.

The best solutions work in real-time. They analyze customer behavior and update risk scores as new information comes in. Then businesses can step in at the right moment, not when it’s too late in the customer’s journey.

Finding high-risk customers early lets businesses use their retention resources better. They can create tailored strategies to fix specific problems before customers cancel.

Build a Churn Prediction Model That Works

A well-laid-out approach helps you build a churn prediction model that turns raw data into practical customer insights. Your model needs to spot customers who might leave early enough to step in and help them stay.

Collect and clean customer data

Quality data forms the backbone of any reliable churn prediction model. You need to gather different types of information from various sources – how customers buy and use products, their talks with customer service, and basic details about who they are. This creates an integrated view of customer behavior patterns throughout their experience.

Your data needs proper preparation before modeling:

- Clean out errors, duplicates, and inconsistent entries

- Fix missing data points properly

- Make number-based variables consistent

- Convert text-based details like location or gender into numbers

- Remove unnecessary information that won’t help predict churn (customer IDs, row numbers)

Feature engineering plays a significant role. Raw data needs conversion into meaningful metrics that show customer behavior clearly. You could track how often people use your product, the average gap between purchases, or how well they respond to marketing.

Choose the right churn prediction model

Different algorithms offer unique benefits based on what your business needs:

Logistic Regression: This simple option helps you learn about what makes customers leave. It works best when you need to explain the results easily.

Decision Trees: These create easy-to-follow visual models based on customer traits that stakeholders can understand quickly.

Random Forest: This method builds multiple trees using different data chunks and combines their predictions. It fights overfitting while spotting complex patterns. You can get good results even with limited data.

Gradient Boosting Machines: These models build step by step, with each new part fixing previous mistakes. The result gives accurate predictions, especially with complex data.

Neural Networks: These excel at finding hidden patterns in large customer datasets.

Review model performance with precision and recall

Looking at accuracy alone can mislead you, especially when churn typically represents 20-25% of customers. Focus on these vital metrics instead:

Precision: This shows what percentage of your predicted churners actually leave. High precision helps save resources by not targeting stable customers.

Recall: This reveals how many actual churners your model catches. Good recall means you find most at-risk customers, though you might flag some loyal ones too.

F1 Score: This combines precision and recall into one balanced metric when both matter equally.

Testing on fresh data through proper validation helps avoid overfitting and ensures your model works in real-life situations.

Act on Churn Signals with Targeted Strategies

Predictive analytics helps spot at-risk customers, but that’s just the beginning. The true value emerges when companies take decisive action through targeted intervention strategies.

Personalize onboarding and feature walkthroughs

Customer relationships depend heavily on effective onboarding. Research shows 86% of customers stay loyal to businesses that provide proper onboarding and continuous education. The flip side reveals 74% of potential customers switch to other solutions due to complicated onboarding processes. We focused on making the original experience easier through guided workflows, tooltips, and personalized welcome emails. This builds trust and guides users toward key actions that deliver quick value.

Trigger proactive support for at-risk users

Smart customer service tackles issues before customers notice them. This forward-thinking approach spots customers labeled as “probable bouncers” (inactive for six months), “lapsed customers” (inactive for 12 months), or “lost customers” (inactive for 36 months). Quick responses to feedback and swift issue resolution show dedication to customer satisfaction. Companies using predictive analytics respond up to 80% faster to at-risk accounts, which creates a strong competitive edge.

Use incentives and loyalty programs wisely

Pre-credited points encourage repeat purchases instead of margin-eating blanket discounts. A smart loyalty program boosts purchase frequency and builds emotional connections with customers. Rewards should match customer values to promote deeper relationships. Lifestyle benefits that align with customer interests can boost retention by a lot.

Reinforce competitive advantages regularly

Customers who forget your unique value won’t stay loyal. Data shows customers who see distinct value stay loyal 2.6x more often, even with cheaper competitors around. Regular targeted communication, case studies, and tutorials show ground value to customers. Compare your customer satisfaction with competitors to find areas needing improvement. Make sure marketing messages highlight your advantages at every touchpoint.

Segment and Prioritize High-Value Customers

Your business doesn’t get equal value from all customers. Research shows less than 1% of customers generate 90% of overall revenue. Smart churn prevention starts by grouping customers based on their future value potential.

Identify high-LTV customers

Customer Lifetime Value (CLV) is the life-blood metric that shows your most valuable customers. This metric looks at a customer’s total revenue throughout their relationship with your business, beyond single purchases. You can find CLV using this formula: “Average order amount × Purchases per year × Retention rate”. The data shows loyal customers are worth up to 10 times their initial purchase. Companies can spot valuable customers by breaking down their audience and tracking CLV across six months to a year.

Create smart customer segments

Multiple models come together to build precise user groups in smart segmentation. The RFM (Recency, Frequency, Monetary) model proves especially useful in preventing churn. This method groups customers by:

- Product engagement history

- Purchase or interaction patterns

- Business value contribution

CHAID (Chi-square Automatic Interaction Detection) helps find statistically significant customer groups with unique characteristics. To name just one example, see how customers who buy more than seven SKUs show the lowest churn rates.

Focus retention efforts where it matters most

Your most valuable segments should get priority for retention resources. Yes, it is more budget-friendly to keep high-CLV segments than low-value ones, which leads to better ROI. Your high-value customers might benefit from:

- Better support options

- Individual-specific loyalty programs

- First access to new features

Each segment needs retention strategies that match their specific value and needs. This approach helps you cut down churn while getting the most lifetime value from your profitable customer relationships.

Conclusion

Customer churn poses a major risk to business growth and profits, but many companies still don’t pay enough attention to keeping their customers. This piece shows how predictive analytics helps businesses prevent customers from leaving instead of just reacting after they’re gone. Your bottom line benefits a lot from this preventive approach.

Businesses gain a real advantage when they use predictive models to spot customers who might leave. They can take specific actions exactly when customers need them most. This analytical method helps companies use their resources wisely and fix customer problems directly.

The numbers make a strong case for keeping existing customers rather than finding new ones. A small 5% boost in customer retention can increase profits by 25-95%, while getting new customers keeps getting more expensive. Existing customers spend 67% more than new ones, which makes effective retention plans even more valuable.

Creating a churn prediction model that works needs clean data, the right algorithms, and careful testing with precision and recall metrics. These models help create individual-specific experiences, support for users who might leave, targeted reward programs, and regular reminders of why you’re better than competitors.

Smart customer grouping is vital for stopping customer churn. Some customers bring more value than others, so focusing on keeping high-value customers makes the most financial sense. The RFM model (Recency, Frequency, Monetary value) gives you a simple but effective way to find your most valuable customers.

Preventing customer churn goes beyond just keeping accounts active, it protects and grows your business’s most important asset: lasting customer relationships. Start with one strategy from this piece, measure how well it works, then do more. Even small improvements in keeping customers can bring amazing results for your business’s growth and future.

Key Takeaways

Master these proven strategies to slash customer churn and boost profitability through data-driven retention tactics.

• Retention beats acquisition: Keeping existing customers costs 5x less than acquiring new ones, with just 5% better retention boosting profits by 25-95%

• Predict before problems arise: Use predictive analytics to identify at-risk customers weeks ahead, enabling 80% faster response times and 15-25% churn reduction

• Focus on high-value segments: Less than 1% of customers drive 90% of revenue—prioritize retention efforts on high-LTV customers using RFM segmentation

• Act on early warning signals: Monitor behavioral changes, support interactions, and usage patterns to trigger personalized interventions before customers decide to leave

• Build targeted intervention strategies: Deploy proactive support, personalized onboarding, and strategic incentives based on specific customer risk profiles and value segments

“If you found this guide useful, join my free Business Intelligence Edge newsletter for weekly, practical data-driven insights to grow your business.”